Knowing your actual salary is the most crucial thing ever. A pay calculator will help you get out of the calculation that may give you confusing figures, and enable you to see the exact amount of what you will be taking home after deductions.

It is a good way to have an overview and be certain and confident whether you are comparing employment opportunities, managing your budget, or preparing yourself to move in your career.

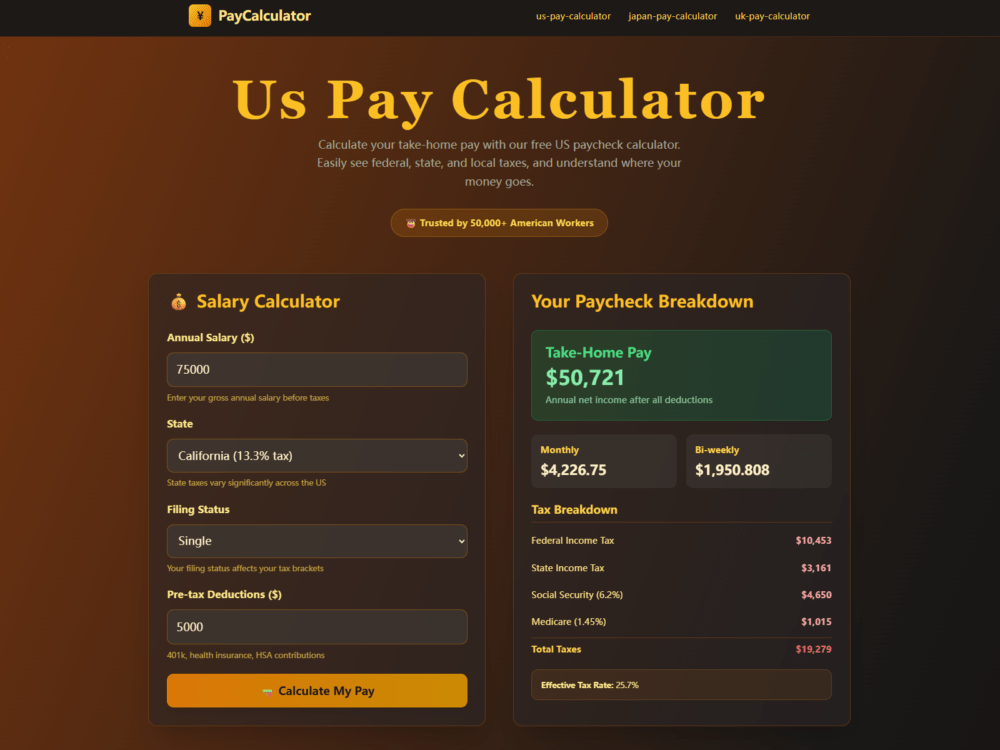

In 2026, with new tax systems, the present pay calculator allows users to estimate earnings correctly across other countries. You can immediately calculate the gross pay, deductions, and final take-home salary without having to do any guessing about the impact of taxes on the income.

Calculating Salaries Across Different Tax Systems

A pay calculator is flexible to other taxation systems and payroll regulations across the world. The users are required to provide simple information, including annual or monthly wages, place, and working type.

The tool then uses country-specific tax laws and contributions rates for the chosen year. This enables one to compare salaries across regions without the in-depth tax knowledge. In the case of 2026, the new calculators have been updated with the new changes in regulations to give more accurate results.

Understanding Federal and State Pay Deductions

A Japan pay calculator 2026 is oriented on federal, state, and payroll taxes. It takes into account income tax levels, Social Security, and Medicare deductions.

There are also many calculators that can be adjusted to the filing status and pre-tax benefits.

This would provide employees with a real idea of the paycheck. Both freelancers and those who work full-time should be aware of such deductions so that they can plan their expenses and negotiate salaries with a lot of confidence.

Professionals Benefit From Pay Calculators

Pay calculators are beneficial to employees, freelancers, human resources teams, and job seekers. They are used by the employees to confirm the payslips and budgets. Income by freelancers is pre-tax income.

They are trusted by the employers and the HR professionals to have a clear wage negotiation. Employment seekers are making equitable comparisons on offers based on the net income rather than the headline numbers.

This makes salary decisions more viable and knowledgeable.

Trust, Clarity, and Updated Tax Accuracy

The current pay calculators are focused on accuracy and simplicity. Users can trust the results of their work as there are clear areas of breakdown that one can see where every deduction has been made.

Revised 2026 tax data will make the estimates in accordance with the existing legislation. Clearly explained features also inform the users and convert complicated payroll systems into user-friendly information. This precision and clarity of information create trust in the long term.

Final Thoughts on Smarter Salary Planning

A pay calculator has become a necessity in the modern, complicated financial environment.

Through a trusted international wage calculator, the user can have a perfect understanding of the actual wages they are earning. You need a net salary calculator in Japan, or you would like to see your salary in relation to those in different countries.

Precise tools will allow you to plan smarter, negotiate better, and take control of your finances in 2026 and beyond.